Markets brace for fed signal shift

- Gold steady on Fed cut expectations

- Dollar softness underpins bullion

- Oil tracks peace talks, supply risks

- Fed path for 2026 still uncertain

- Volatility seen if Fed surprises

Gold and oil are entering the Fed meeting with direction but limited conviction.

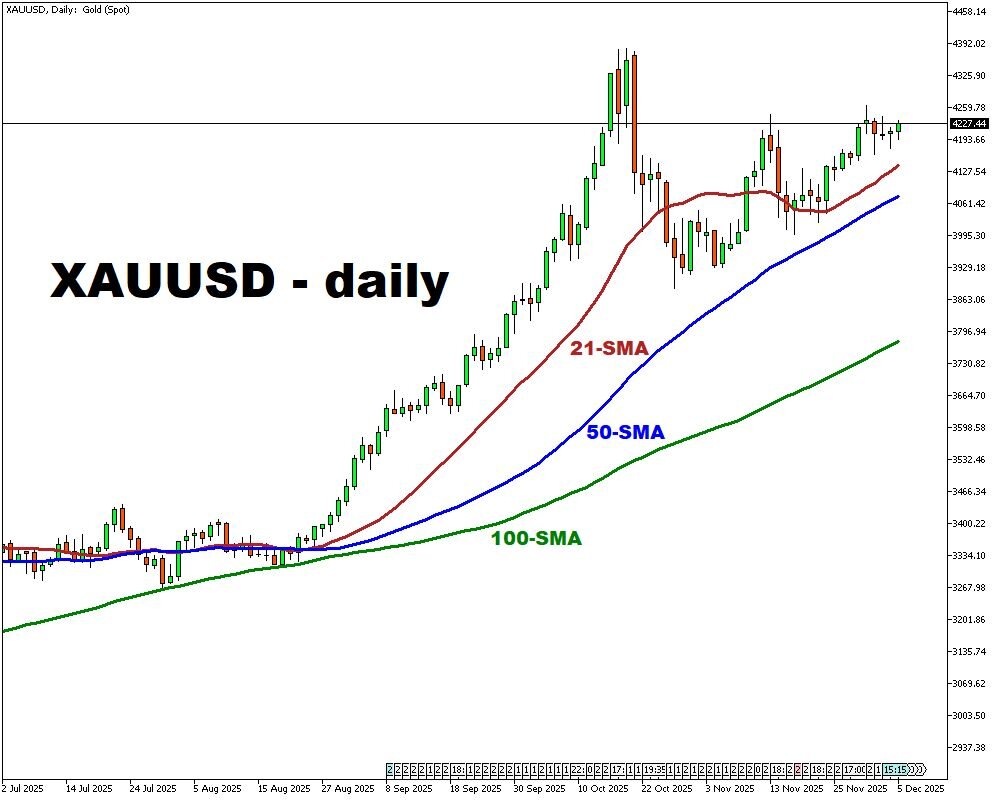

Gold remains supported near the $4,200 area as traders lean toward a third Fed cut this year and a softer dollar.

The missing October CPI and NFP data leave policymakers navigating a rare information gap, and a divided FOMC increases the risk of a surprise. A clear dovish tilt could lift bullion toward $4,300, while weakness below $4,200 would refocus attention on $4,180–4,160.

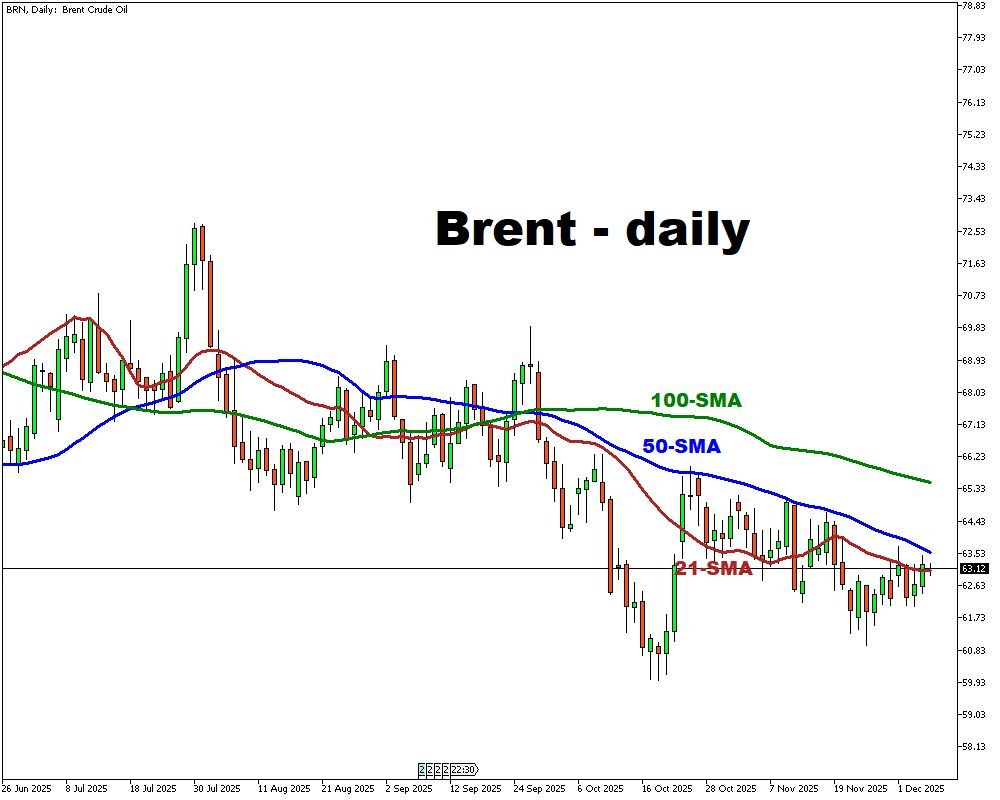

Oil is holding in the low-$60s, shaped by geopolitical currents and shifting rate expectations.

Markets continue to monitor Ukraine–Russia peace efforts, which, if sustained, could eventually revive speculation about partial sanctions relief, though that remains a distant and political call.

Oversupply concerns persist into 2026, keeping Brent capped near its 50-day average. A break under $62.50 may expose $61.50 and $60, while strength above the average could open a path toward $65.

Across both markets, the key variable is the Fed’s forward guidance. Traders now see fewer cuts priced for 2026, so any hint of a longer easing cycle would likely weaken the dollar and lift commodities, while a more hawkish tone risks a sharp reversal.