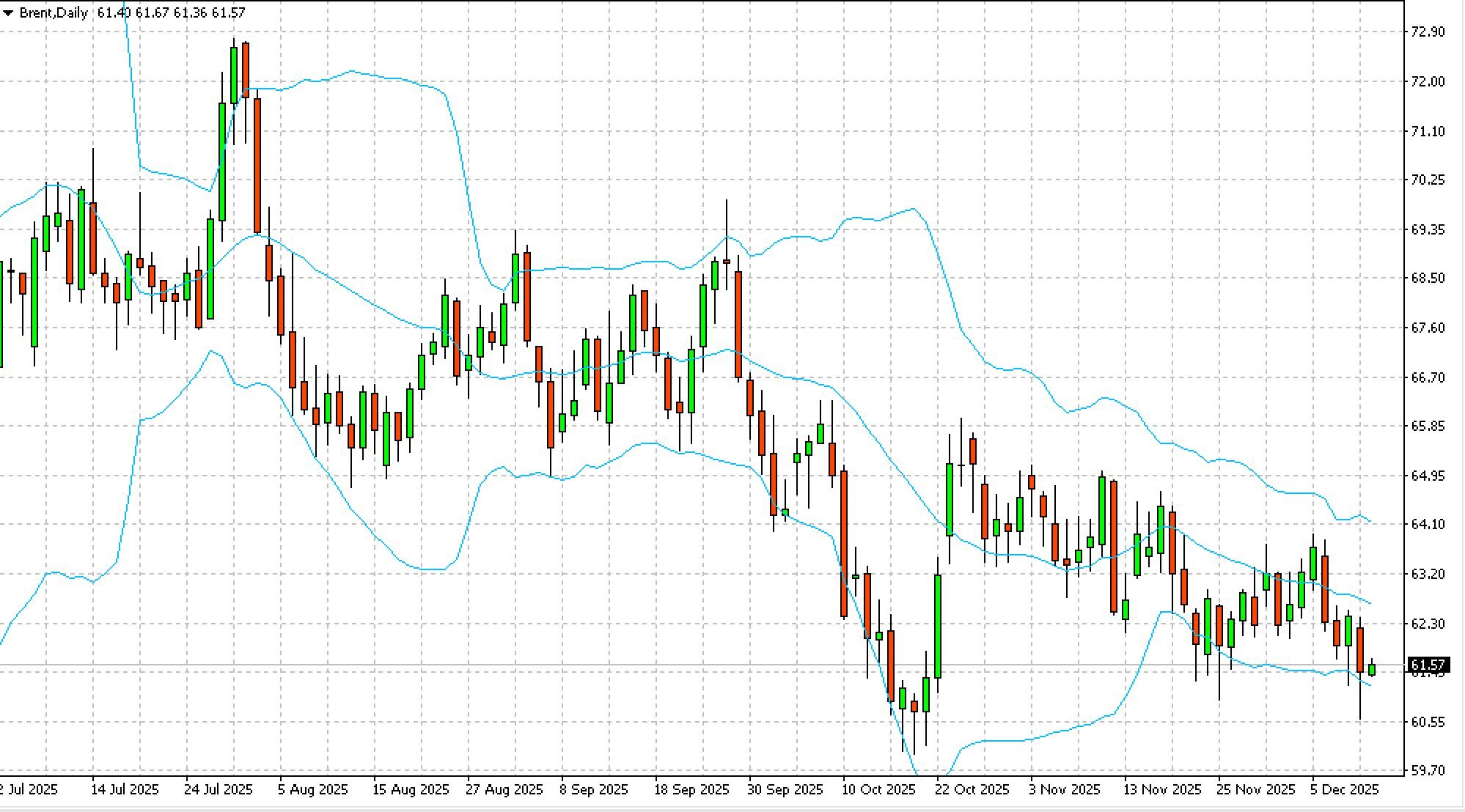

Brent slides further

- Brent falls toward $61.50 per barrel

- Technical target at $61.00

- Weekly decline exceeds 3%

- IEA flags record oil surplus

- Geopolitics weighs on prices

Brent crude prices are falling toward $61.50 per barrel on Friday. From a technical perspective, Brent on the daily timeframe has met all previously identified targets and is now moving toward the $61.00 level.

For the week, prices are heading for a drop of more than 3%, driven by expectations of a global supply surplus. The International Energy Agency has confirmed its forecast of a record oil glut, although it slightly lowered its estimate compared with last month. The agency also noted that global oil inventories have risen to their highest level in four years. At the same time, OPEC left its forecasts for global demand and supply in 2026 unchanged, pointing to a more balanced market outlook.

Geopolitical factors also influenced price dynamics during the week. The United States intercepted a sanctioned Venezuelan tanker, a move Caracas described as an “act of piracy.” Venezuela, which holds the world’s largest oil reserves, exported around 586,000 barrels per day last month, mainly to China.

In addition, another tanker from the so-called “shadow fleet” linked to Russian oil trading was attacked. This marks the fifth such incident since late November, despite U.S. efforts to push for a ceasefire.